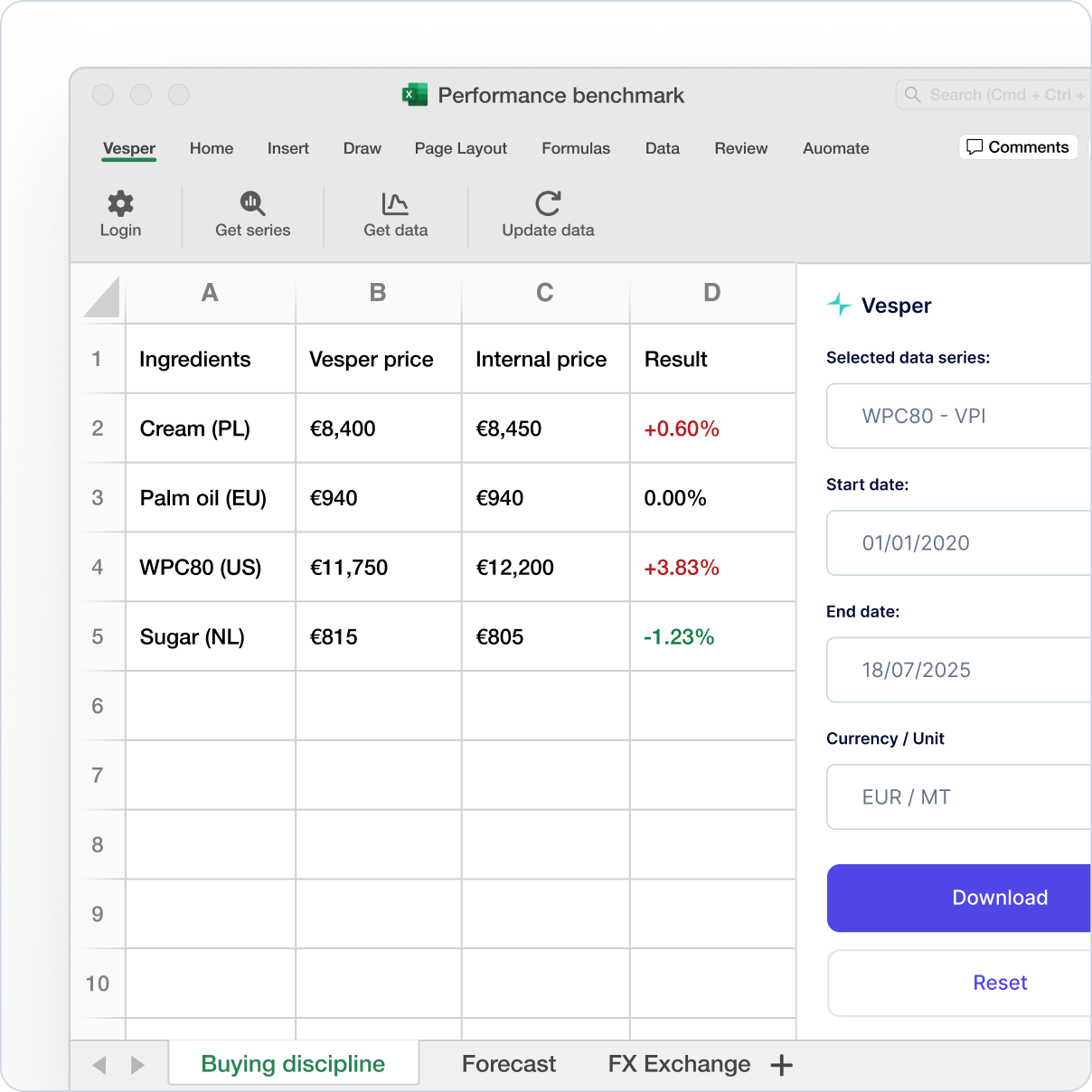

Vesper has launched Vesper for Excel, a powerful new integration that brings Vesper's live commodity intelligence directly into your spreadsheets. This feature eliminates manual data entry, allowing teams to spend less time maintaining spreadsheets and more time analyzing markets with real-time data feeding directly into the models and templates they already use.

What's New:

One-Click Refresh: Update all Vesper data in your spreadsheets instantly. With a single click, you can access real-time prices, forecasts, FX rates, and fundamentals.

Direct Data Access: Pull data from over 160 global sources directly into any cell in your spreadsheet.

Native Integration: Vesper for Excel lives natively within your Excel, integrating seamlessly with your existing workflow and templates.

No Coding Required: Perfect for procurement, finance, and sales teams who need live data in spreadsheets without any technical overhead.

Why It Matters: The time spent on manual data collection and entry is time lost on strategic analysis. Vesper for Excel automates this process, ensuring the latest market information always powers your most critical models. It shifts your team's focus from data maintenance to data-driven decision-making.

How to Use It:

Download the add-in from the Microsoft Excel marketplace.

Log in with your Vesper API Excel key.

Set up once by using the Vesper for Excel sidebar to choose the data you need (e.g., commodity, price type, date range).

Click "Refresh" at any time to update all data points in your sheet instantly.

How to access? Reach out to your customer success manager or [email protected] to learn more about the Excel Add-in or the various options to extract or integrate Vesper data directly into your workflows

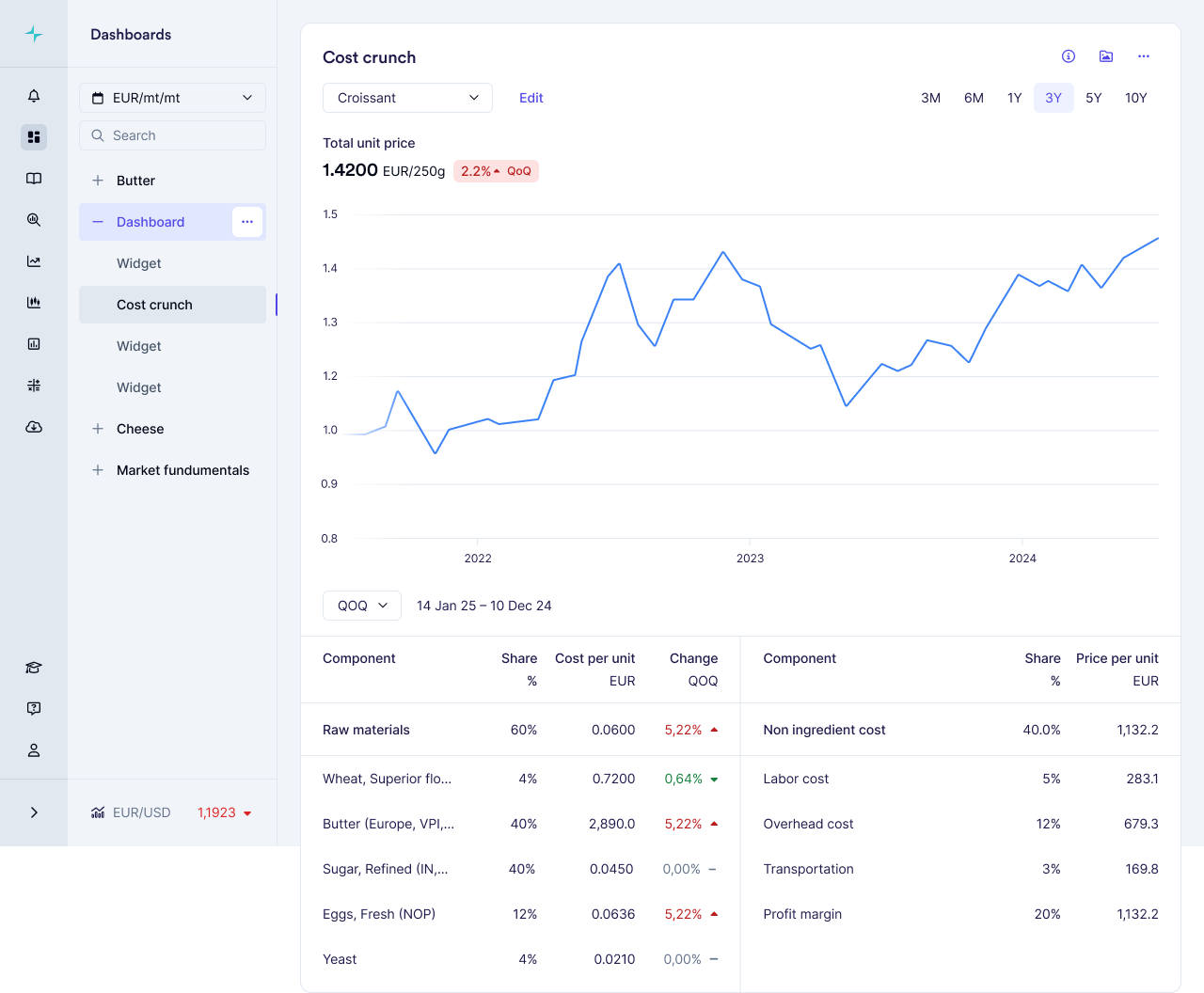

What data? Vesper for Excel offers seamless access to Vesper's data:

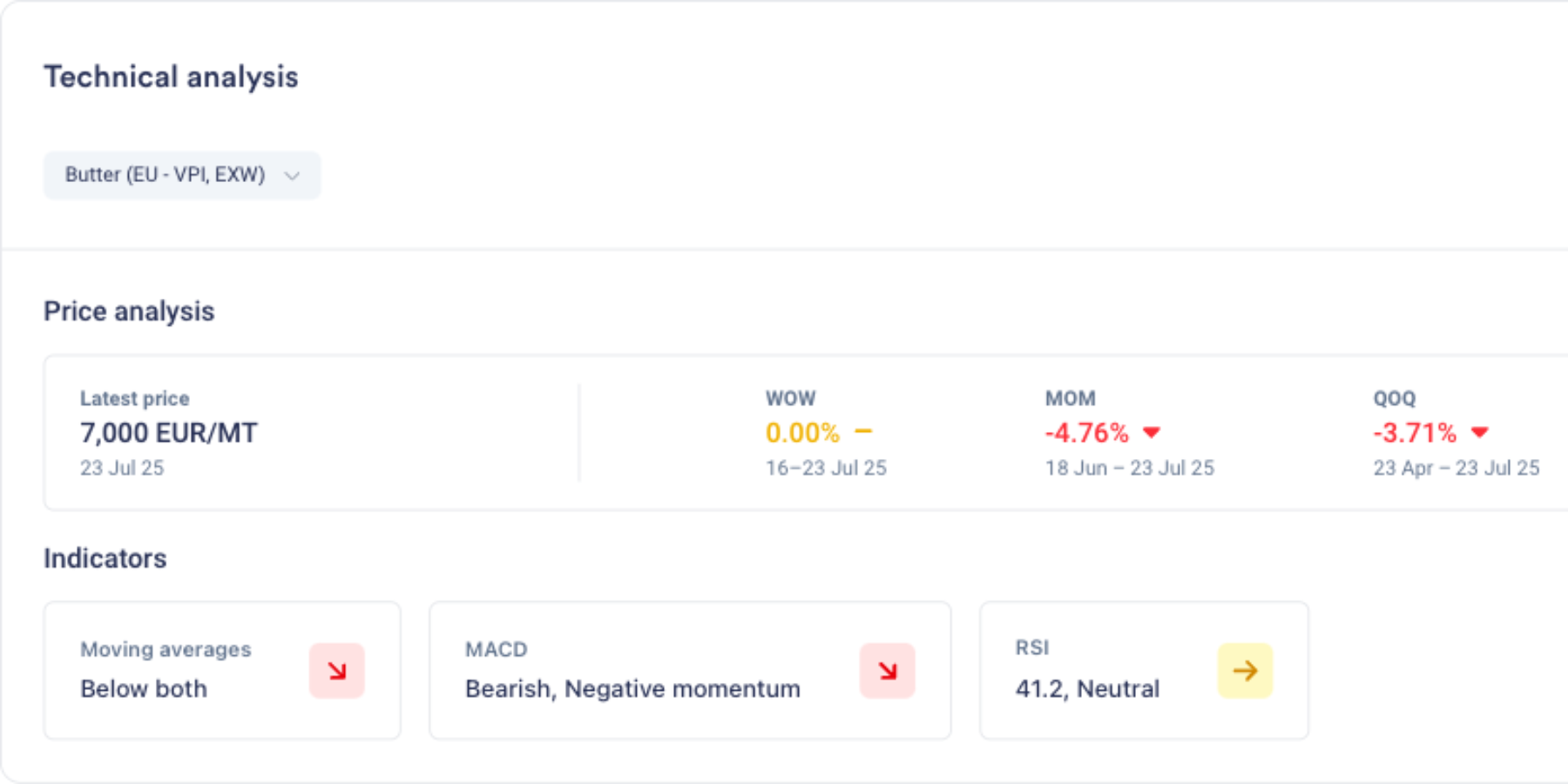

Vesper Price Index (VPI)

Partner and Public price benchmarks

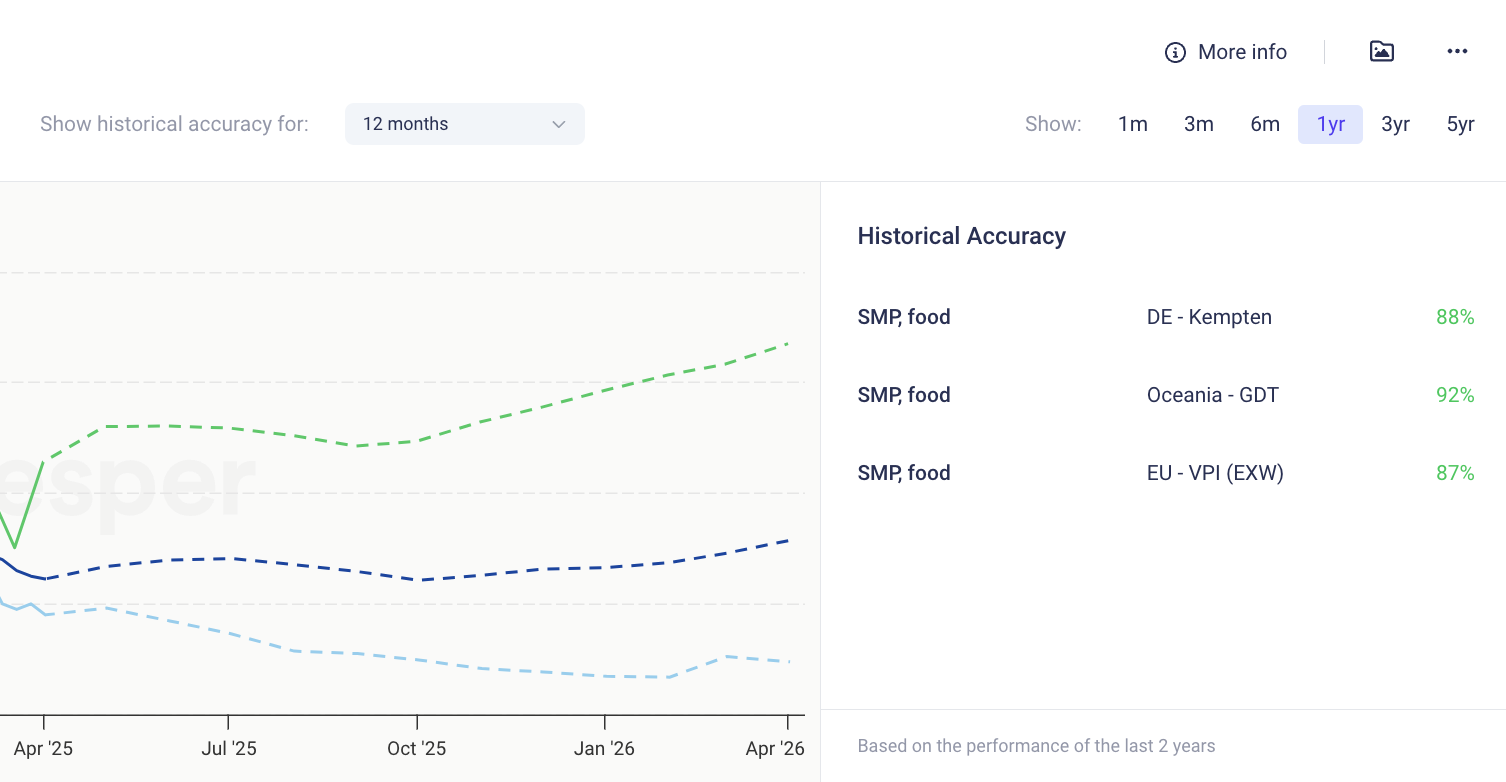

Forecasts for Price, Production, and Stock levels

FX rates

Global trade data

S&D/Fundamental data

Stock levels