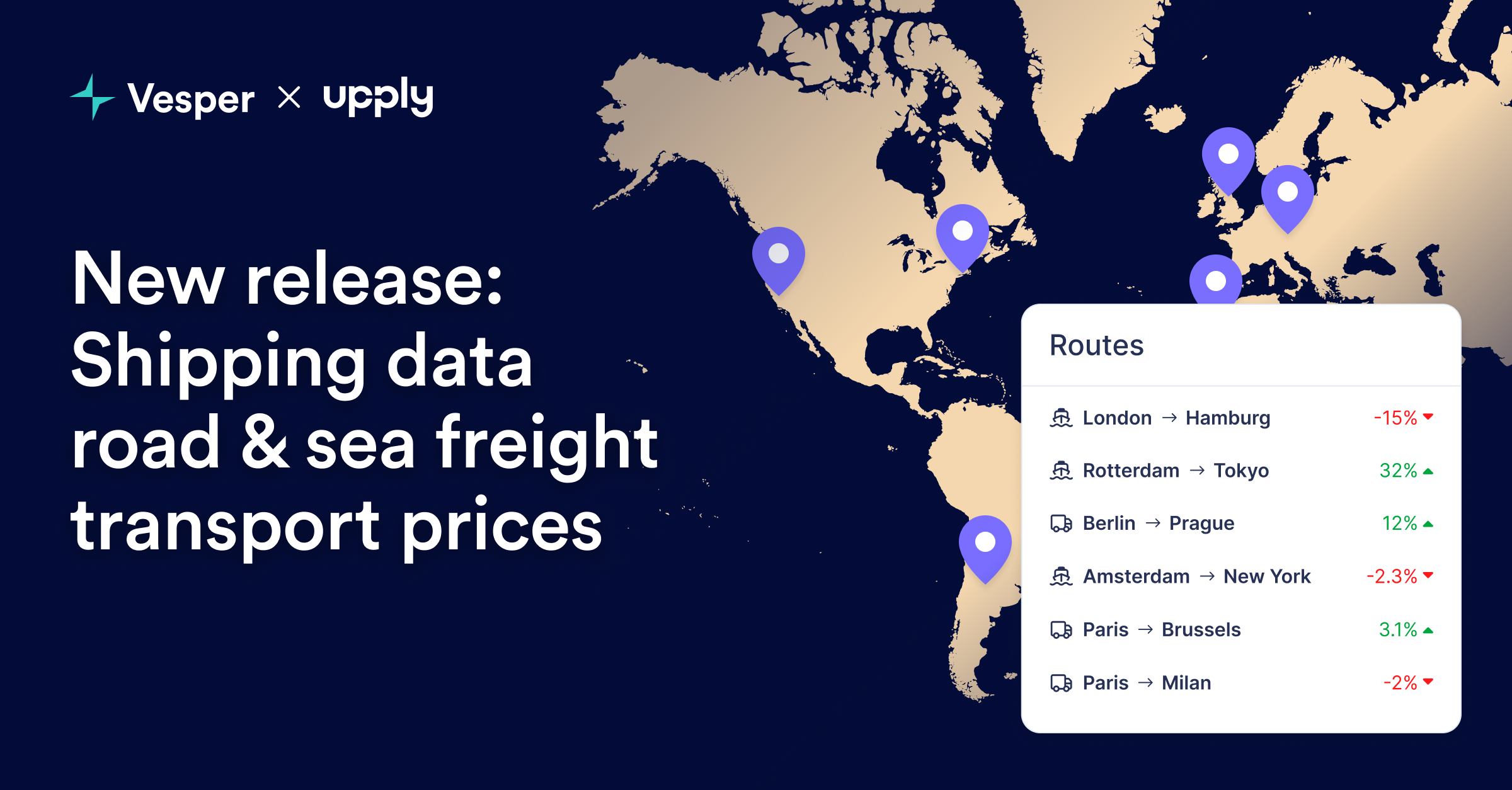

Vesper has launched Commodity Shipping Intelligence through an exclusive partnership with Upply, bringing freight rate benchmarks directly into the platform. This integration enables procurement teams to track delivered costs by combining commodity prices with real shipping rates for their specific inbound lanes—creating true landed cost visibility.

What's New:

Inbound Freight Benchmarks: Real shipping rates for strategic procurement routes, not generic freight indices

Upply Partnership Integration: Access to validated freight data from one of Europe's leading logistics intelligence providers

Route-Specific Pricing: Targeted lanes for commodity imports (origin ports to destination factories)

Multi-Modal Coverage: Ocean freight, road transport, and intermodal combinations where relevant

Integrated Cost Analysis: Combine commodity prices with freight to calculate true delivered costs

Why It Matters: Commodity prices at origin tell only half the story. With shipping costs representing 10-30% of delivered prices and extreme volatility in freight markets, procurement teams need visibility into both components. This integration transforms Vesper from a commodity price platform into a complete landed cost intelligence system—critical for accurate budgeting and supplier selection.

How to Use It:

Search freight routes using origin-destination pairs in the platform search

Add to dashboards alongside relevant commodity prices for complete cost tracking

How to access? Freight rates are available to all Vesper users who have access to the Energy and Transport category. For more information, contact [email protected].